| Founding Year | 1994 |

|---|---|

| Address | 35 Efal St., Kiryat Arie, Petah Tikva - View Map |

| Phone | 03-5555555 |

| Fax | 03-5653955 |

| Social Networks | |

|---|---|

| Company Website | www.555.co.il |

I.D.I. offers “more insurance” through a unique, advanced, and simple customer service experience for the client at the moment of truth, alongside attractive prices.

I.D.I. is a public company controlled by the Schneidman Family and the public. From its first day, I.D.I. has set its sights on being a groundbreaking brand in the insurance field. From its first days, I.D.I. has led many consumer, business and marketing moves that changed the face of insurance in Israel.

I.D.I. operates in two main fields: general insurance, which includes motor insurance (comprehensive-third party and compulsory), homeowners, mortgage, business, and foreign travel, as well as life insurance, which includes life insurance, health, personal accident, and savings, with the lowest management fees in the market. I.D.I.’s uniqueness is that, as part of its strategic concept, it maintains direct contact with its existing and potential clients, without the mediation of insurance agents. Through a variety of communication channels IDI offers its clients a wide variety of advanced digital services, allowing them to enjoy high availability and a unique, simple and accessible user experience with a complete response at the moment of truth, when the client needs the insurance company the most.

2022 was a challenging year in the insurance industry in general, and in motor insurance in particular, but nevertheless, I.D.I. managed to create a competitive advantage in the motor insurance market and maintain its strength even in times of upheaval. The innovative steps, level, and customer service experience that clients receive are also reflected in client satisfaction surveys. In 2022, 97% of all I.D.I.-insured parties expressed high satisfaction with the level of service.

Breakthrough Innovation

I.D.I. leads with innovative and progressive activities and continues to develop new products in accordance with market requirements, while maintaining stability and growth, initiating and leading the technology of groundbreaking moves and ethical and fair conduct towards its clients, employees, suppliers, and the environment. As part of its desire to grant its policyholders a broad range of products for their changing needs, I.D.I. launched cyber coverage in homeowners insurance that aims to prevent, protect and deal with cyber-attacks, that have become a common risk.

As a leading digital company, I.D.I. works tirelessly to create tools and moves in the field of technology and data, in order to provide an exceptional level of service in the world of insurance. I.D.I. continues to develop the digital infrastructures that enable a direct, accessible, efficient, and available channel for its clients (service through the WhatsApp application, digital forms, “bot” technology, payment of claims via “Bit” and more).

A year ago, I.D.I. launched its “Direct Club”, the first and only customer club in the insurance industry.

I.D.I. also continues to operate in a unique collaboration with MSI, the Japanese insurance giant, which established a joint innovation lab (HUB) in the field of “insurtech” to identify startups, technology companies and promotes innovative and ground-breaking ideas that come up, among other things, by employees, an idea competition among Startup companies and more.

I.D.I.’s Operations and a Description of its Business Development

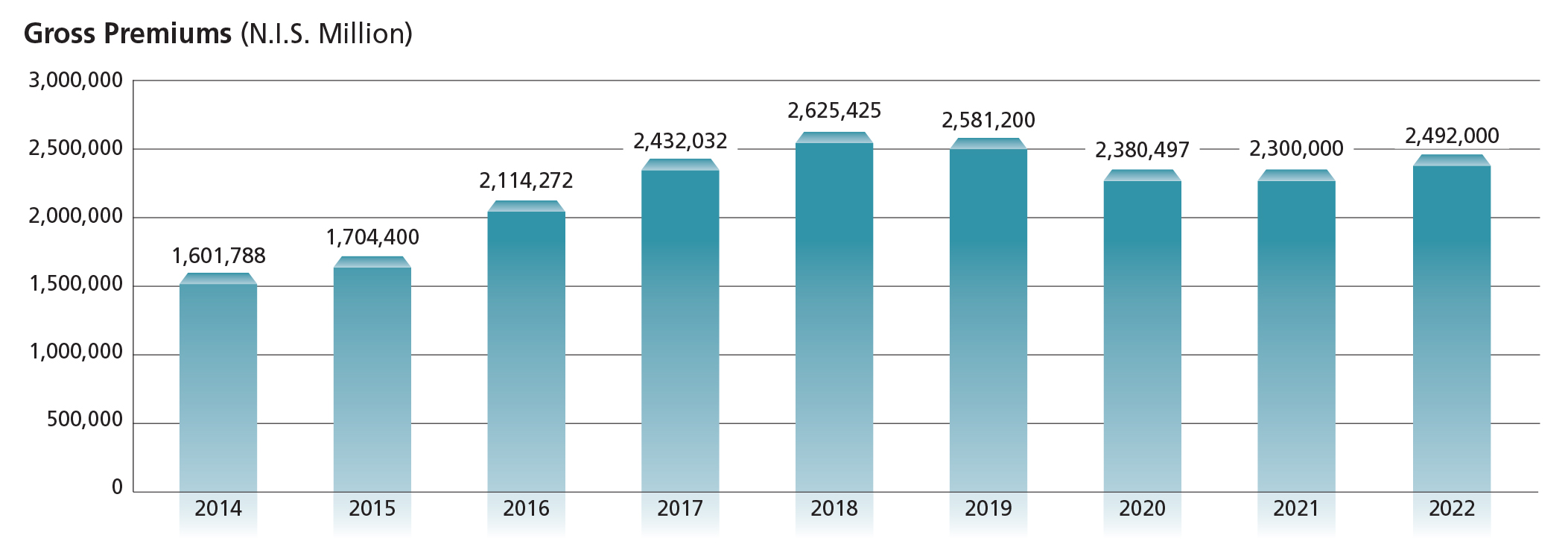

According to I.D.I.’s 2022 financial reports, earned premium totaled NIS 2.492 billion, while total income totaled NIS 51.1 million.

Human Capital

I.D.I. has 1,600 employees and attaches great importance to the internal development of its human capital. This year, I.D.I. again was placed at the top of the rankings of “Best Companies To Work For,” and this year reached the honorable 6th place (the first in the ranking that is not a hi-tech company) while maintaining its 1st place ranking in the finance field. The organizational efforts to nurture its workforce include a unique basket of benefits, development and enrichment paths, care, and concern for the individual.

Contributing to the Community

As an insurance company leading the direct insurance revolution in Israel and striving to enable every citizen to receive insurance services at fair prices, I.D.I. considers itself committed to the community in which it operates. As a pioneering insurance company leading in innovation, I.D.I. has chosen to focus its contribution to the community on fostering excellence and empowering the future generation with an emphasis on disadvantaged populations by making knowledge accessible and promoting education for the technological world.

I.D.I. is ranked in the highest category in the 2022 “Ma’ale” rating – Platinum Plus and is included in the “Ma’ale” index on the Tel Aviv Stock Exchange.

I.D.I. Insurance Company Ltd., in Numbers (31.12.22)

• Annual premium volume – NIS 2.492 billion.

• Underwriting profit NIS (2.5) million.

• Total profit – NIS 51.14 million.

• Equity – NIS 855.5 million.

ranking of leading urban renovation companies in Israel CofaceBdi 2017 To continue reading the article in Hebrew

From the resurgence of cybersecurity to deals seeking to bring cannabis firms to stock exchanges, here are the trends that shaped Israeli M&A in 2018

Which company Israelis think it is best to work for? Every year, as in the last 13 years, we perform the employees survey among tens of thousands of employees in Israel with the aim to analyze their satisfaction from their workplace and in parallel to examine what is important to the Israeli worker about his […]

CofaceBdi Combined risk index summary for October 2017 Deterioration in the Combined risk index of Israel’s economy * About 13.25% of the companies were rated in high and dangerous risk levels * Heading the weak and dangerous branches: Coffee shops and Transport services * Heading the strongest and secure branches: Pharmaceutical and cosmetics industry and […]