| Founding Year | 1987 |

|---|---|

| Address | 36 Raul Wallenberg St., Kiryat Atidim, Tower 8, Tel Aviv ADDRESS 36 Raul Wallenberg St., Kiryat Atidim, Tower 8, Tel Aviv MAILING ADDRESS P.O.B. 37070, Tel Aviv 6136902 - View Map |

| Phone | 972-3-6387777, *5454 |

| Fax | 972-3-6387676 |

| [email protected] | |

| Company Website | www.clal.co.il |

In terms of gross earned premiums, the Group’s market share is 15% of the insurance market (in 2022), and the volume of assets it manages exceeds NIS 332 billion (as of September 2023). Clal Insurance Company Ltd. is rated ilAA+ by Ma’alot – Standard & Poor’s, while Midroog Ltd. has rated Clal Insurance as Financially Stable at Aa1 (IFS).

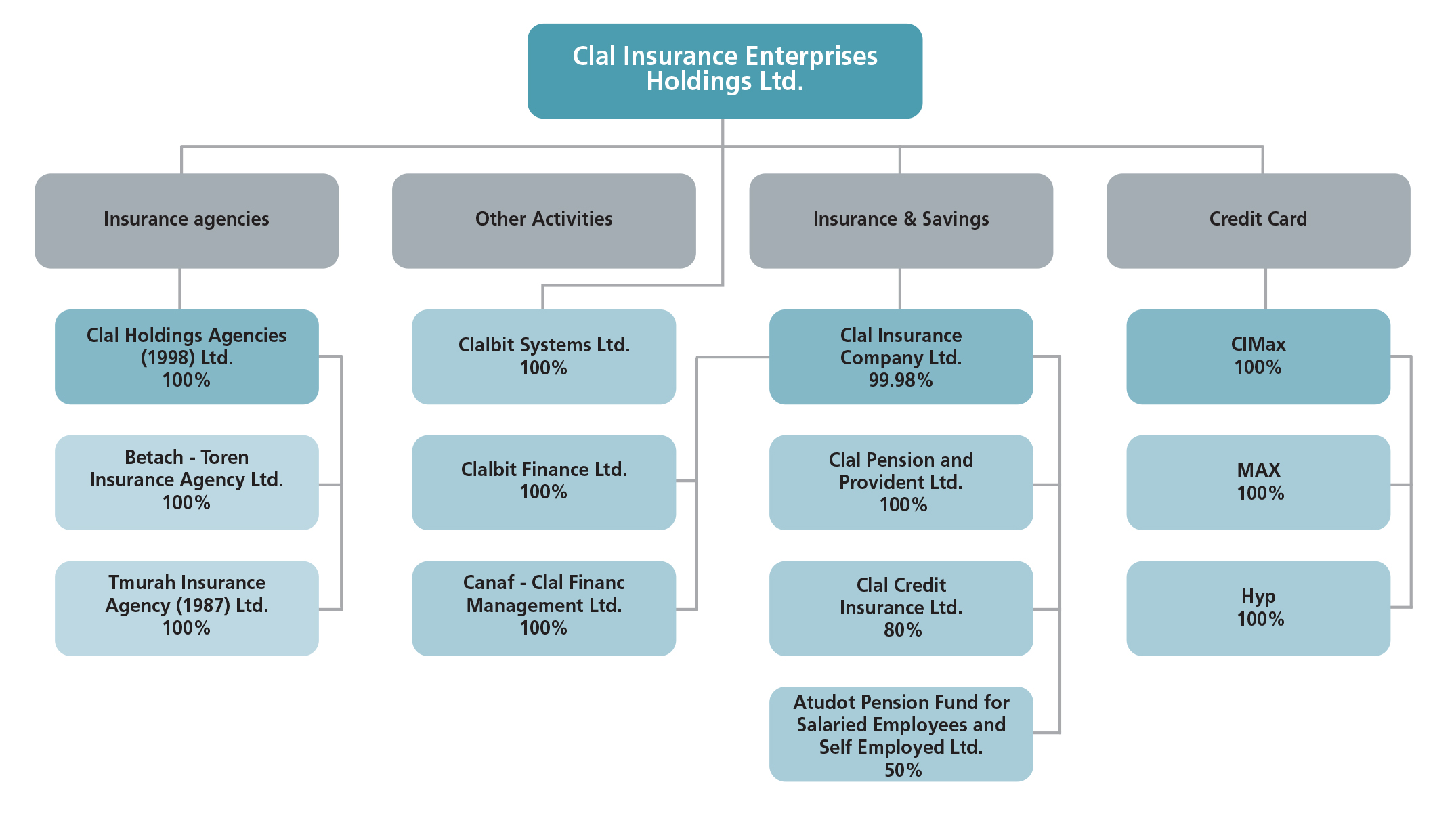

In March 2023, Clal acquired Max from Warburg Pincus, a US investment fund, and its partners. The Clal Group operates in several diverse insurance and long-term savings areas, such as pension, provident and advanced training funds, general insurance such as car and home, health insurance and credit cards. In addition, the Group has a unique activity among insurance companies in mortgages and credit insurance. Since 2023, the Group has also been active in the credit card industry.

The Clal Group owns insurance agencies, pension funds, provident funds, training funds, and a credit insurance company. As of December 2022, the Group has 4,403 employees at Clal Insurance and Finance and the insurance agencies and 1,337 employees at Max. All said, place Clal as one of Israel’s leading long-term insurance and savings groups.

Long-Term Savings

Clal Insurance and Finance provides comprehensive solutions for long-term savings, including life insurance, pensions, provident funds, provident funds for investment, and financial savings for private and business parties in all sectors of the economy. The Clal Insurance and Finance Group has a market share, based on assets, of 14% of the long-term savings market in Israel, as the Supervisor of Insurance defines this term. The Group’s new pension funds manage assets totaling NIS 123 billion for its 550 thousand members, and the provident funds manage NIS 59 billion for its 450 thousand members (as of September 2023). In life insurance, the Group holds a market share of 21% in terms of premium, with total annual premiums of NIS 6.8 billion (in 2022).

General insurance

Clal Insurance and Finance is one of Israel’s leading companies in general insurance, with an annual premium volume of NIS 3.1 billion (in 2022). The Company offers a wide spectrum of insurance plans for individuals and businesses in cars, homes, properties, and more, with professionalism and expertise while understanding the unique needs of its diverse clientele.

Health Insurance

The division manages annual premiums totaling NIS 1.6 billion (in 2022) and offers its clients a variety of private health insurance policies, foreign travel insurance policies, and more. The basket of private health insurance policies provided by the Company allows its policyholders to choose the appropriate coverage that meets their needs, with correct pricing and professional accompaniment, understanding the trends and changes in the industry and under them.

Investments

Canaf – Clal Financial Management Ltd. is a wholly owned subsidiary of Clal Insurance and Finance, one of the Israeli economy’s largest and most stable financial companies and one of the largest non-banking institutional investors in Israel. Canaf, as the group’s investment arm, manages assets totaling NIS 316 billion (as of September 2023), including insured parties’ pension funds, provident funds, executive insurance, and the equity and insurance reserves of the Clal Group.

MAX

MAX was founded in early 2000 and quickly became an Israeli credit and payment brand, issuing 3 million active credit cards and providing various financial services to some 70,000 businesses. MAX offers multiple financial services, including credit card issuance, benefits, clearing services, loans, credit solutions, and advanced payment options such as mobile and contactless payment.

MAX markets its various financial solutions to private customers, including custom credit and loan solutions and credit cards that enable the intelligent and customized management of expenses. The Company’s customers can execute many actions easily and quickly on the site and in the MAX app. In business financial services, MAX offers clearing and discount services, loans, business cards, and other financial and marketing solutions. MAX strives to encourage the transition to new technology payment terminals to enjoy safe transactions and a decrease in fraud while increasing usability on smart cards and mobile payments.

Service and Innovation

Clal Insurance and Finance strives to remain a leading, innovative, and caring company. The Company promotes solutions that provide its clients with added value in all areas of its activity and promotes a high-quality and personalized service experience under the “Be glad That You Are With Clal” slogan. The message, part of the Company’s communication language, reflects the face of Clal Insurance and Finance as a leading financial company in the Israeli economy, with decades of experience, but also current, innovative, and dynamic.

In recent years, Clal has planned a new service strategy, which is based foremost on trust as a critical value for the Company’s success – to create a stable and genuine relationship with its clients – agents and insured parties, to be there for them in the moments of truth and routine, and to give them security and peace of mind, to create a relationship based on transparency and genuine commitment. All Company employees share this worldview and take an active part in creating an accurate end-to-end customer journey.

Clal strives to provide excellent and quality service for its clients and agents at the moment of truth. Accordingly, it seeks to offer digital tools, innovative services, and unique products adapted to the changing needs of today’s clients and to make it possible to receive service and manage insurance and savings products anywhere and at any time. For Example:

The “Clal Button” App – the first app of its kind in Israel’s insurance industry, which offers a wide range of services – is an emergency button that calls for urgent help from the relevant service providers in the areas of car, home and travel claims abroad, without waiting on the line and in a simple and short process. The app allows policyholders to contact the Clal Insurance and Finance call center anytime and to ask for various emergency and rescue services – in case of an accident, home flooding, delayed luggage abroad, or a medical event abroad. The app connects calls directly to the call center, video calls from the accident scene, and WhatsApp calls, and allows for filing a quick claim. In this way, the Company gives the insured party security and high availability in Israel and abroad. The app also allows receiving information and transactions on the personal account, viewing route data, including BEHAVE, purchasing insurance coverage for a temporary/inexperienced driver, joining a provident fund for investment, and more.

Clal BEHAVE is a unique product on the market that encourages safe driving. The unique route in comprehensive car insurance – Clal BEHAVE, allows drivers to influence the amount of their monthly premium payment and provides a significant discount of up to 40% per year, reflecting the amount of travel (mileage) and the quality of driving – through the “Clal Button” application. The product provides a comprehensive service experience – helps improve driving, and allows the driver, in the event of an accident, to receive immediate assistance in real-time. The route has many advantages for young drivers and their parents, who can enjoy peace of mind, along with an advanced application that enables a comprehensive experience for many drivers of all ages.

24/7 service – Clal provides a team of bots that provide service to the company’s clients via WhatsApp in a variety of areas, 24/7, when the face of the move is 5 of the company’s employees, excellent service providers. The new service connects to the information systems and provides clients with relevant information on various topics – pension, provident, life, health, overseas, general insurance, and claims – while the service centers are closed. This service is an obvious example of how Clal harnesses innovation processes alongside maintaining personal contact with the clients.

Guaranteed Couples Pension – this year, Clal Pension and Provident launched a new model for its successful program – “Guaranteed Pension” – “Guaranteed Couples Pension.” This is a unique plan in general pension, with a significant consumer benefit that meaningfully reduces management fees to both spouses who choose to save through a general pension plan, thus granting more significant savings for retirement age, and competitive management fees. “Guaranteed Couples Pension” is based on a revolutionary model that offers management fees known in advance throughout the savings period until retirement, which decrease as the accumulated balance in the fund increases, similar to the benefits of a “Guaranteed Pension.” The innovation now gives the two spouses who join Clal’s pension fund an additional significant benefit in the rate of management fees.

Medical screening tests at the client’s home – this year, Clal Insurance and Finance launched another unique collaboration with the MP Check company, as part of which Clal grants an exclusive and significant benefit to new entrants to a life insurance policy in case of death of the “Sapir” type, for undergoing medical screening tests directly at the policyholder’s home. New policyholders who purchase “Sapir” life insurance, with an insurance amount exceeding NIS 1,300,000, will benefit from the right to medical screening tests for early detection and life-saving, which will be held at the policyholder’s home, with a deductible of only NIS 50. Eligibility for a screening test is once every two years (limited to up to 7 screening tests during a period of 15 years from the beginning date of insurance in the policy).

Medical Mashlim Sha’ban Extra – this year, Clal Insurance and Finance launched its new Medical Mashlim Sha’ban Extra, a health policy that provides coverage for private surgeries and surgery substitutes in Israel after the rights in the Sha’ban program have been exhausted. Clal set up a dedicated team in the claims system to handle Sha’ban supplementary claims. The team is responsible for providing a high-quality and professional end-to-end response to the insured and Clal’s insurance agents, including explaining how to submit the claim, checking the affiliation of the surgeon – whether in an arrangement with Clal and/or with the Sha’ban, handling the stages of the claim and more. In addition, as part of the handling of the claim, Clal provides a commitment for the insured’s deductible directly to the hospitals, with no client involvement.

Clal’s Resilience Center is the company’s flagship project in corporate responsibility. The Resilience Center provides information and assistance in times of distress, in areas such as emotional, financial, and health issues, when professional help and guidance are needed. The project is undertaken in collaboration with leading non-profit organizations and organizations in Israel. It is open and accessible to the entire Israeli public, free of charge, in the general button app and on the company’s website.

In corporate responsibility, Clal was placed, and for the fourth consecutive year, in the ESG ranking. Clal holds the highest “Platinum +” rating and is included in the group of leading companies in Israel in the field of corporate responsibility. This award demonstrates Clal’s commitment to advancing issues in the field of corporate responsibility, which have a social and environmental impact, as part of its ongoing business conduct. This is the first year that Clal has also participated in the 2023 Diversity and Inclusion ranking of Ma’aleh and the Equal Opportunities Commission at the Ministry of Economy and Industry. This new ranking also won the highest score–five stars! The Diversity and Inclusion rating works to examine data on diversity percentages in the company, the organization’s contribution to the subject, and administrative actions that promote an inclusive work environment that encourages a sense of belonging.

As part of its 2023 social activity, Clal donated NIS 5 million under its strategy to support non-profit organizations and other entities working to cultivate populations with special needs, including sick populations and underprivileged populations, with an emphasis on nurturing children and populations of young people, even in aspects of encouraging education.

47% of the contractors expect prices to continue rising In spite of Government efforts – only 39% of the contractors expect an increase in branch’s activity this year, 47% of the contractors expect dwelling prices to continue rising, 82% of the contractors expect the collapse of construction realization companies to continue this year too. […]

Adv. Yoheved Novogroder-Shoshan (Hi-tech Partner) and Adv. Miriam Friedmann (Hi-tech Associate) “Information is the oil of the 21st century, and analytics is the combustion engine.” Peter Sondergaard. One of the most significant commodities of our era is data. The availability and novel methods of processing data has enabled medical practitioners to take tremendous strides in […]

From the resurgence of cybersecurity to deals seeking to bring cannabis firms to stock exchanges, here are the trends that shaped Israeli M&A in 2018

CofaceBdi Combined risk index summary for October 2017 Deterioration in the Combined risk index of Israel’s economy * About 13.25% of the companies were rated in high and dangerous risk levels * Heading the weak and dangerous branches: Coffee shops and Transport services * Heading the strongest and secure branches: Pharmaceutical and cosmetics industry and […]